List of Categories

- Aerospace & Defense

- Agriculture

- Animal Nutrition & Wellness

- Automation

- Automotive

- Chemical & Materials

- Consumer Goods and Services

- Electronics

- Energy & Mining

- Financial Services & Investment Intelligence

- Food & Beverage

- Healthcare

- Heavy Industry

- Home & Property Improvement

- Information & Communications Technology

- Investment Opportunities

- Manufacturing

- NEO

- Others

- Packaging

- Retail

- Technology & Media

- Transportation & Logistics

Sorted by Name

Publishers

Categories

Countries

Vietnam Retail Sector – Growth, Trends and Forecast 2019-2024

| NEO | Published by: Mordor Intelligence | Market: |

| 157 pages | Published: 21-06-2019 |

Market Snapshot

Study Period:

2015-2024

Base Year:

2018

Key Players:

Market Overview

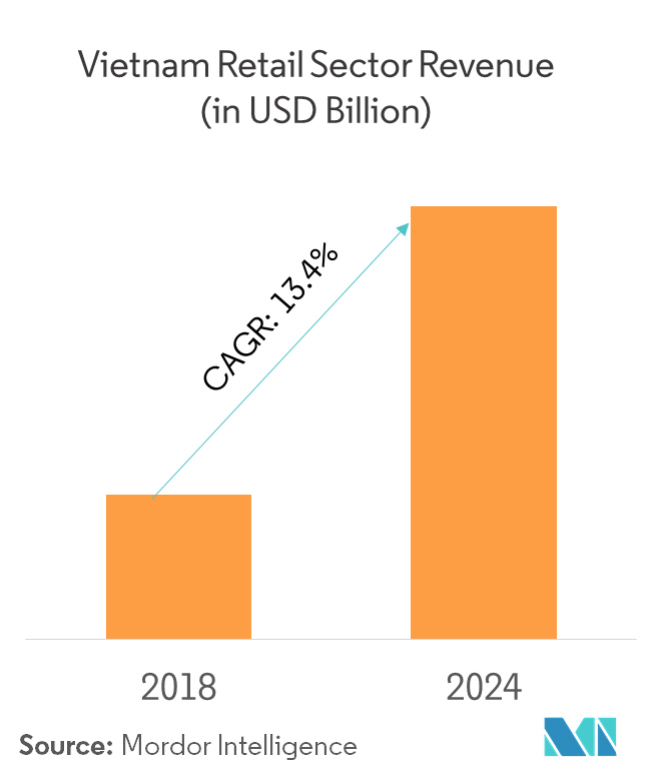

The Vietnamese retail sector is projected to register strong double-digit growth during the forecast period, 2019 to 2024. The market is segmented by product category, distribution channel, and market dynamics.

- Modern retail outlets also offer private brands/products that can be exclusively purchased in their stores. In this way, they can assure every consumer that the products they sell are specially made to fit the demands and needs of their shoppers.

- One key factor involved in Vietnamese consumers choosing to shop in traditional markets is that they can buy ingredients in smaller portions. In response to this, supermarkets are offering RTCs or ready-to-cook packages that are better suited for the daily needs of an average consumer.

- Food products, non-food products, and home appliances are also offered in supermarkets, which makes shopping easier, as they offer everything needed for the customer under one roof.

- To further improve the shopping experience, some stores have in-house bakeries and cafés where consumers can hang out and enjoy with family or friends.

- The local population’s inclination to make their purchases in the traditional outlets are hinged owing to factors, such as high availability of these outlets everywhere in the country posing convenience and ease of access for consumers, comparatively lower prices of goods and products (which consumers can still bargain), fresh produce supply source that is better at wet markets, and traditional retailers offering flexible package sizes for day-to-day consumption.

Scope of the Report

A complete background analysis of the Vietnamese retail industry includes an assessment of the parental market, emerging trends by segments and regional markets, significant changes in market dynamics, and market overview.

BY PRODUCT CATEGORY Food and Beverage and Tobacco Products Personal Care and Household Apparel, Footwear, and Accessories Furniture, Toys, and Hobby Industrial and Automotive Electronic and Household Appliances Pharmaceuticals, Luxury Goods, and Other Products Key Market Trends

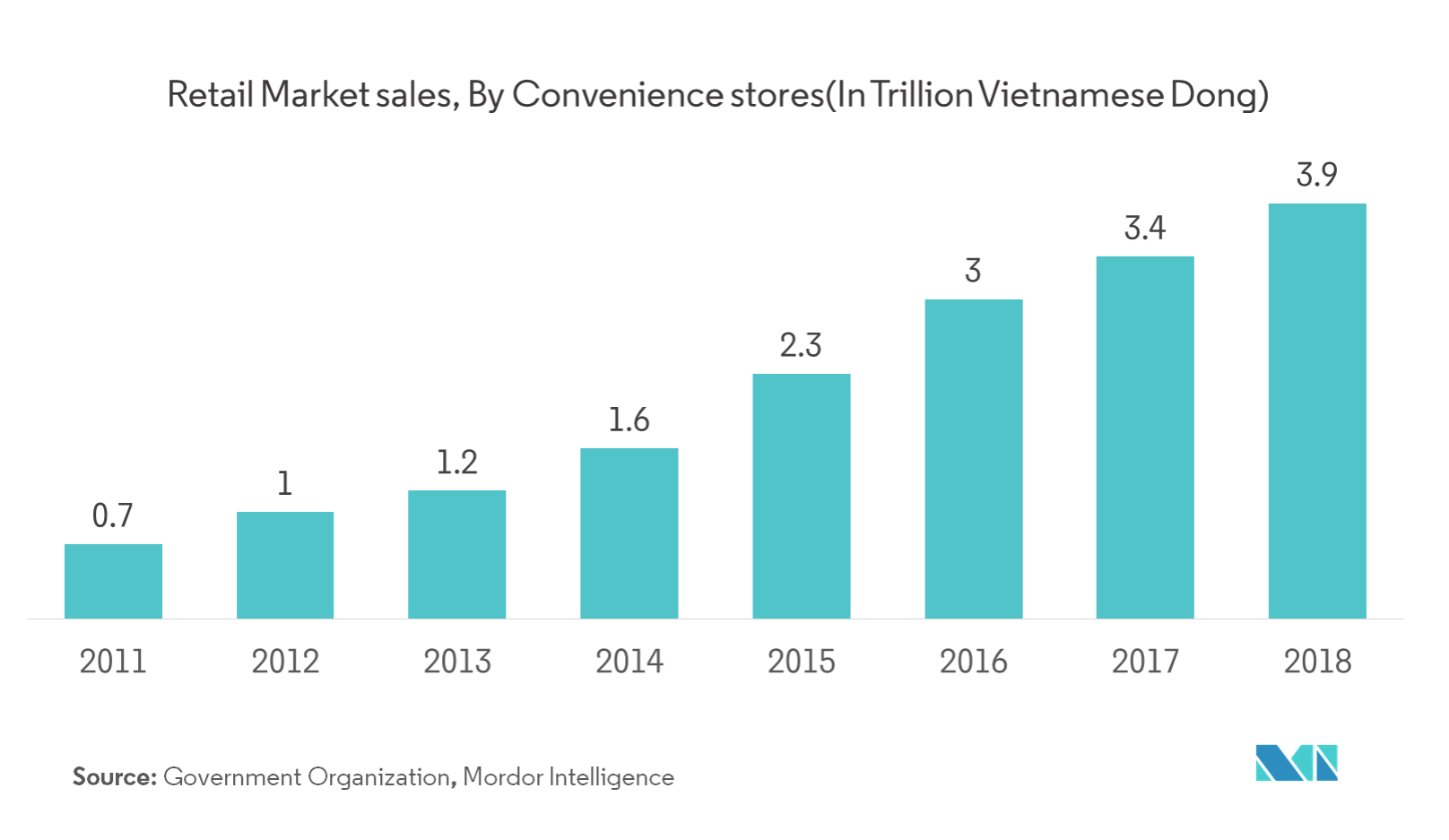

Growth of Convenience Stores Market

- In 2018, nearly 74.7% of the total market share went to retailing of products bought for use. Other sectors took up a share of the retail market, including accommodation, catering, and travel services.

- The growth of modern trade (fast-moving consumer goods) has been greater than traditional retail, owing to broad factors, such as the growing economy, increasing urbanization, a younger population, and rising incomes.

- Nearly 40% of the population of Vietnam is under 25 years of age, and their average income per capita has been growing at a rate of around 30% every couple of years.

- This age bracket of consumers shows increasing confidence in spending patterns. In 2017, over 63% of Vietnam chose to use spare cash for savings, which was down from 76% in 2016. More consumers are spending on clothing, consumer electronics, vacations, and urban out-of-home entertainment.

- The growing middle and affluent classes and the younger population value convenience and comfort. There is growth in the convenience store market, due to the expansion of companies, such as Circle K, which is expanding across Hanoi, and already has a strong foothold in Ho Chi Minh City.

- The increasing presence of local players, such as Vinmart+, which has nearly 900 stores all over the country, and the recently introduced Bach Hoa Xanh by Mobile World, which plans to have about 1000 stores in Ho Chi Minh city, are helping expand the retail market of Vietnam.

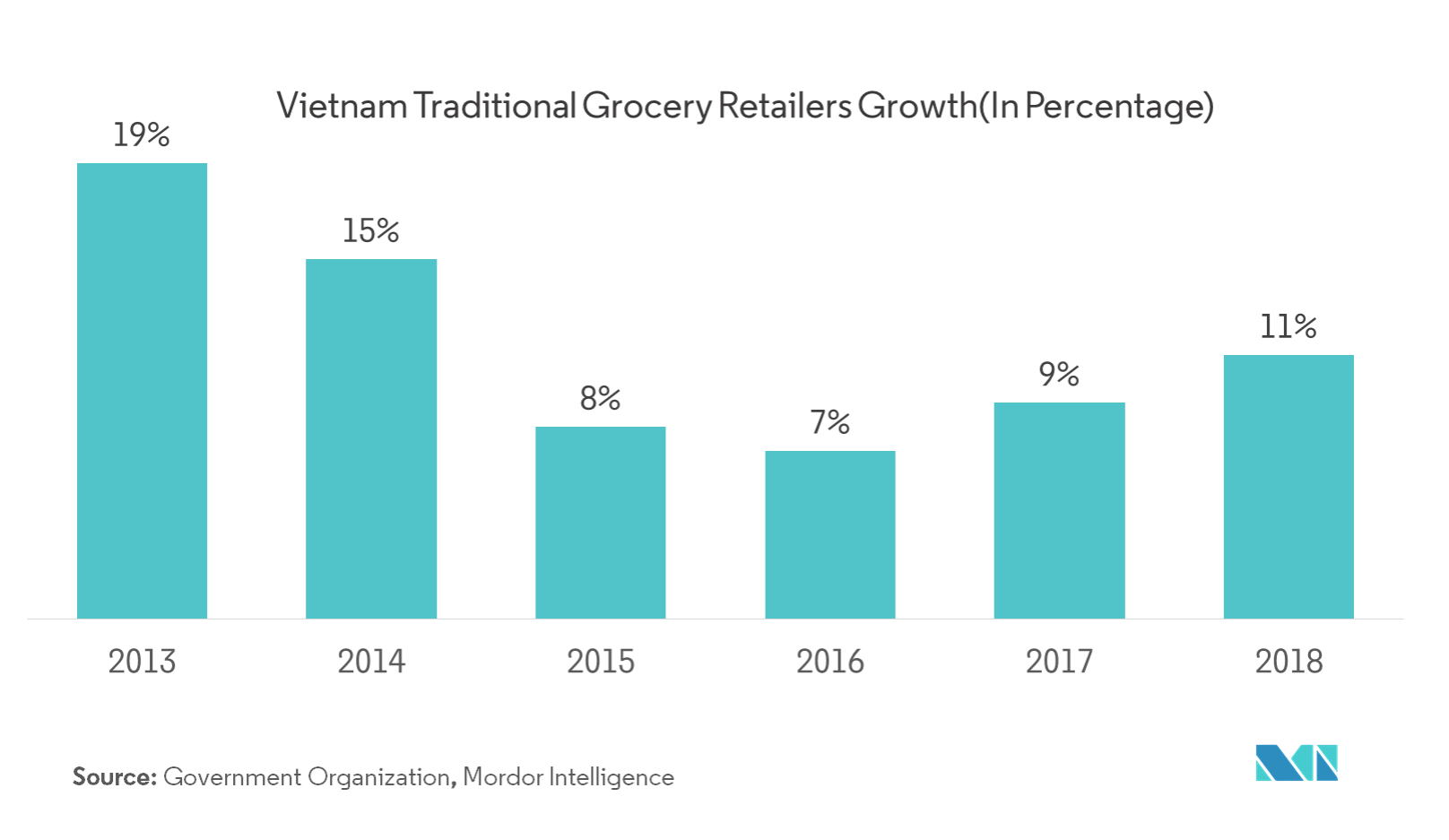

Food Retail Industry is Dominated by Traditional Retailers

- Revenue in the food and beverage sector is expected to grow annually by 3.0% (2019-2024).

- The food retail industry in Vietnam is dominated by traditional retailers. As of 2018, the traditional retailers accounted for 94% of the retail grocery sales, and the remaining 6% sales contributed to modern retail sales.

- According to industry experts, modern retail sales are expected to reach 18% of the total food retail sales by 2024.

- The highly-dominated food landscape of the country, with wet markets and small businesses, is witnessing tremendous growth in the concept of the modern retail trade, with a growing number of convenience stores, hypermarkets, and supermarkets.

- Traditional retailers, with lower rental and operational costs, have flexibility with packaging sizes and competitive prices. These traditional stores are ideal for purchasing small quantities at higher frequencies, so that fresh produce can be obtained.

- With more than half of the young population, the consumption of food and beverages in the country is witnessing huge growth. Also, as of 2016, the annual growth of the country’s population was 1.1%, which indicated an increase in customers, as food is an essential item.

- According to GSO, the sales of food and foodstuffs increased by 11.1%, in 2017.

Competitive Landscape

The report covers major international players operating in the Vietnamese retail market. In terms of market share, few major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

Major Players

1. INTRODUCTION

1.1 Key Deliverables of the Study

1.2 Study Assumptions

1.3 Research Methodology

2. SCOPE OF STUDY

3. MARKET INSIGHTS

3.1 Market Overview

3.2 Customer Behavior Analysis

3.3 Industry Attractiveness – Porter’s Five Forces Analysis

4. MARKET DYNAMICS

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Industry Value Chain Analysis

5. TECHNOLOGY SNAPSHOT

6. MARKET SEGMENTATION

6.1 BY PRODUCT CATEGORY

6.1.1 Food and Beverage and Tobacco Products

6.1.2 Personal Care and Household

6.1.3 Apparel, Footwear, and Accessories

6.1.4 Furniture, Toys, and Hobby

6.1.5 Industrial and Automotive

6.1.6 Electronic and Household Appliances

6.1.7 Pharmaceuticals, Luxury Goods, and Other Products

7. INSIGHTS ON DISTRIBUTION CHANNELS IN RETAIL TRADE

7.1 Hypermarkets, Supermarkets, and Convenience Stores

7.2 Specialty Stores

7.3 Department Stores

7.4 E- commerce

7.5 Other Distribution Channels

8. COMPANY PROFILES

8.1 Saigon Co.op.

8.2 Central Group

8.3 AEON

8.4 Vin Group

8.5 Lotte Mart

8.6 E-Mart

8.7 Auchan

8.8 Shop & Co.

8.9 Parkson

8.10 Big C

*List Not Exhaustive

9. INVESTMENT ANALYSIS OF THE VIETNAM RETAIL SECTOR

10. FUTURE OF THE VIETNAM RETAIL SECTOR

MARKET SEGMENTATION

BY PRODUCT CATEGORY

Food and Beverage and Tobacco Products

Personal Care and Household

Apparel, Footwear, and Accessories

Furniture, Toys, and Hobby

Industrial and Automotive

Electronic and Household Appliances

Pharmaceuticals, Luxury Goods, and Other Products

SOUTH KOREA RETAIL SECTOR – GROWTH, TRENDS AND FORECAST (2019 – 2024)

| NEO | Published by: Mordor Intelligence | Market: |

| 152 pages | Published: 07-06-2019 |

- NEO

- Mordor Intelligence

- 152 pages

- Published: 07-06-2019

Market Overview

The South Korean retail industry is one of the largest markets among the Asian countries. Modern retail businesses, such as hypermarkets, grocery supermarkets, convenience stores, and online retailing, has rapidly grown over the years, in comparison to that of traditional retail outlets, comprising street markets and family-operated small retailers.

Although the South Korean economy is expected to grow slowly during the forecast period, retailing is estimated to register positive sales growth, owing to the significant rise in internet retailing, aggressive marketing, and promotional activities from major retailing companies

However, the introduction of a number of shopping malls, with elegant restaurants, trend-setting brands, cutting-edge multiplex movie theaters, and high end supermarkets led to a change in consumer life style, and this change is leading to a more advanced retail experience in South Korea.

Scope of the Report

A complete background analysis of South Korea retail Industry, which includes an assessment of the parental market, emerging trends by segments and regional markets, significant changes in market dynamics, and market overview is covered in the report

Key Market Trends

Retailers Embrace Digital Strategies to Engage Customers

Increasing number of local retailers have drawn on digital technologies to provide better shopping experience for customers. As a case in point, Lotte has launched a new smart shopping service “Smart Shopper†at its food stores of Lotte Department Store Bundang branch. The new service, which replaces the physical shopping carts, allows customers to shop by just scanning the bar codes of products with a shopper handheld scanner device provided in store.

Customers can complete the payment at dedicated self-checkout terminals by tapping the handheld device against NFC readers and after the payment, they can have their purchases delivered home.

Another major retailer Hyundai Department Store has also introduced a quick search service “Smart Finderâ€, with which shoppers can find their desirable products quickly at Hyundai’s online store. Smart Finder can analyze the designs, colors, and patterns of the products, in the photos uploaded by shoppers and recommend similar products, saving up to 50% on searching time. New convenience formats and themes are driving the growth of modern trade, while hypermarkets look forward to retain relevance by remodeling low performance stores into wholesale formats.

South Korea Is One Of The World’s Most Exciting Beauty Markets

South Korea is one of the world’s most exciting beauty markets. New beauty trends and innovations, featuring sophisticated ingredients and aesthetically appealing packaging are constantly on display. South Korean-branded cosmetics labels have earned popularity, particularly within Asia, with the rise of the country’s cultural presence, otherwise known as “hallyu,†and continue to attract image conscious local consumers and foreign tourists.

South Korea is one of the world’s most exciting beauty markets with new beauty trends and innovations that feature sophisticated ingredients and aesthetically appealing packaging are constantly on display.

In retail, South Korean consumers purchase beauty and personal care products not only from online retailers, but via home shopping and door-to-door sales opportunities, also in flagship stores, department stores, health and beauty stores, duty-free shops, aesthetic salons, and medical institutions, and pharmacies, among others. Facial skincare holds for more than half (51%) of the total market share in retail sales and projected at 5.2% CAGR over the next five years.

Competitive Landscape

The report covers major international players operating in the South Korean retail sector. In terms of market share, few of the major players currently dominate the market. However, with factors, such as, technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets.

Reasons to Purchase this report:

– The market estimate (ME) sheet in Excel format

– Report customization as per the client’s requirements

– 3 months of analyst support

Table of Contents

1. Introduction

1.1 Key Deliverables of the Study

1.2 Study Assumptions

1.3 Research Methodology

2. Scope of Study

3. Market Insights

3.1 Market Overview

3.2 Customer Behavior Analysis

3.3 Industry Attractiveness – Porter’s Five Forces Analysis

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Industry Value Chain Analysis

5. Technology Snapshot

6. Market Segmentation

6.1 BY PRODUCT CATEGORY

6.1.1 Food and Beverage and Tobacco Products

6.1.2 Personal Care and Household

6.1.3 Apparel, Footwear, and Accessories

6.1.4 Furniture, Toys, and Hobby

6.1.5 Industrial and Automotive

6.1.6 Electronic and Household Appliances

6.1.7 Pharmaceuticals, Luxury Goods, and Other Products

6.2 BY DISTRIBUTION CHANNEL

6.2.1 Hypermarkets, Supermarkets, and Convenience Stores

6.2.2 Specialty Stores

6.2.3 Department Stores

6.2.4 E–Commerce

6.2.5 Other Distribution Channels

7. Company Profiles

7.1 Lotte Holdings Corporation Limited

7.2 Everyday Retail Company Limited

7.3 Hyundai Home Shopping Network Corp

7.4 Mega Mart Co. Ltd

7.5 Shinsegae Department Co. Ltd

7.6 7-Eleven

7.7 E-Mart Inc.

7.8 Costco Wholesale Korea Ltd

7.9 Homeplus Co. Ltd

7.10 Grand Department Store Co. Ltd

8. Investment Analysis on the South Korea Retail Sector

9. Future of the South Korea Retail Sector

Market Segmentation

Market Segmentation

BY PRODUCT CATEGORY

Food and Beverage and Tobacco Products

Personal Care and Household

Apparel, Footwear, and Accessories

Furniture, Toys, and Hobby

Industrial and Automotive

Electronic and Household Appliances

Pharmaceuticals, Luxury Goods, and Other Products

BY DISTRIBUTION CHANNEL

Hypermarkets, Supermarkets, and Convenience Stores

Specialty Stores

Department Stores

E–Commerce

Other Distribution Channels

AUSTRALIA RETAIL SECTOR – GROWTH, TRENDS, AND FORECAST (2019 – 2024)

| NEO | Published by: Mordor Intelligence | Market: |

| 158 pages | Published: 07-06-2019 |

- NEO

- Mordor Intelligence

- 158 pages

- Published: 07-06-2019

Market Overview

Australia’s Retail Sales grew 3.7 % Y-o-Y in Sep 2018, compared with a 3.7 % increase in the previous month. This sector is segmented on the basis of product category, distribution channel, and market dynamics.

Australia is one of the most urbanized societies in the world, with about 24 million people (90% of the population) living in the urban areas of Sydney, Melbourne, Adelaide, Brisbane, and Perth, as well as in smaller cities and towns within 100 miles of the ocean. Australia registered a significantly high per capita GDP, value at about USD 50,000. Furthermore, it recorded the second highest average wealth per adult.

The Australian retail sector witnessed a positive growth, despite significantly low increase in wages and rising household debt. Strong growth registered by the housing market, supported by low interest rates and increase in household credit, and impacted the consumer spending pattern.

Americans and Australians have a strong relationship that spans the history of both nations. Australia and the United States share a common heritage, culture and language and have supported each other in every major international crisis of the past century.

Scope of the Report

An in-depth analysis of the Australian retail sector, along with an overview of the parent market, regional markets, emerging trends, and market dynamics.

Key Market Trends

Foreign Companies are Formulating New Approaches in Retailing

The future of the Australian retail sectors depends on disruptive forces, such as changing consumer spending patterns and influx of foreign companies that focus on formulating new approaches in retailing.

Furthermore, the sector is facing disruption. The rising influx of foreign companies has not only changed the retail landscape, but also the consumer preferences. There is a significant shift in consumer preferences, primarily due to the advancements in technology.

The Australian retail sector requires agility and multiplicity of delivery platforms, which can identify non-responsive retailers. The sector registered a growth rate of 5%, 3%, and 2.6% in New South Wales, Victoria, and South Australia, respectively.

The Australian economy’s growth was majorly driven by private investments in the mining and housing markets, with core inflation at 1.75%, which is significant lower than the target formulated by the Reserve Bank.

Significant Growth Registered by the Apparel and Footwear Market

The Australian apparel and footwear market is expected to register a CAGR of 3.0%, annually. The Women and Girl Apparel segment is the major revenue contributor to the market, and is expected to be dominant throughout the forecast period.

The sportswear segment witnessed the strongest growth, driven by the athleisure trend. Due to this trend, a large number of consumers are opting active wear in the non-sports category. The athleisure trend, especially prevalent in the women’s wear category, is driving the demand for several categories, such as leggings and sport footwear. Internet retailing emerged as a prominent channel among apparel and footwear retailers.

In 2017, this channel witnessed a significant increase in its value share across the apparel and footwear categories. This was primarily driven by high mobile penetration in Australia, along with a significant shift toward the online distribution channel.

Competitive Landscape

The report provides an overview of major international players operating in the Australian retail sector. Currently, some of the major players are dominating the sector, in terms of revenue share. few. However, minor companies (mid-size and small) companies are focusing on improving their presence by securing new contracts and entering into new markets.

Reasons to Purchase this report:

– The market estimate (ME) sheet in Excel format

– Report customization as per the client’s requirements

– 3 months of analyst support

Table of Contents

1. Introduction

1.1 Key Deliverables of the Study

1.2 Study Assumptions

1.3 Scope of the Study

2. Research Methodology

3. Executive Summary

4. Market Insights and Dynamics

4.1 Market Overview

4.2 Customer Behavior Analysis

4.3 Industry Attractiveness – Porter’s Five Forces Analysis

4.4 Drivers

4.5 Restraints

4.6 Opportunities

4.7 Industry Value Chain Analysis

4.8 Technology Snapshot

4.9 Insights on Distribution Channels in Retail Trade

4.9.1 Hypermarkets and Supermarkets and Convenience Stores

4.9.2 Specialty Stores

4.9.3 Department Stores

4.9.4 Other Distribution Channels

4.10 E- Commerce Trend in Retail Sector

5. Market Segmentation

5.1 By Product Category

5.1.1 Food and Beverage and Tobacco Products

5.1.2 Personal and Household Care

5.1.3 Apparel, Footwear and Accessories

5.1.4 Industrial and Automotive

5.1.5 Electronic and Household Appliances

5.1.6 Pharmaceuticals, Luxury goods, and Other Products

6. Competitive Landscape

6.1 Vendor Market Share, Mergers & Acquisitions

6.2 Company Profiles

6.2.1 ALDI Group

6.2.2 Metcash Limited

6.2.3 Woolworths Group Ltd

6.2.4 Big W

6.2.5 Wesfarmers Ltd

6.2.6 JB Hi-Fi Ltd

6.2.7 Kmart Australia Limited

6.2.8 Myer Group Pty Ltd

6.2.9 David Jones Properties Pty Limited

6.2.10 Kogan.com Ltd

7. Investment Analysis on the Australian Retail Sector

8. Future of the Australian Retail Sector

Market Segmentation

- By Product Category

Food and Beverage and Tobacco Products

Personal and Household Care

Apparel, Footwear and Accessories

Industrial and Automotive

Electronic and Household Appliances

Pharmaceuticals, Luxury goods, and Other Products

TAIWAN RETAIL SECTOR – GROWTH, TRENDS AND FORECAST (2019 – 2024)

| NEO | Published by: Mordor Intelligence | Market: |

| 148 pages | Published: 07-06-2019 |

- NEO

- Mordor Intelligence

- 148 pages

- Published: 07-06-2019

Market Overview

Retail sales in Taiwan increased by 1.95% year-on-year in December of 2018, much higher than an upwardly revised 0.6% gain in November. The market is segmented by product category, distribution channel, and market dynamics. Demographics are playing a major role in determining shopping preferences, with many older Taiwanese consumers buying their meat, fish, fruits, and vegetables at specialist markets.

In response, some supermarkets are trying to attract this consumer group by recreating the look of a more traditional market within their stores; they have achieved some success, particularly in urban areas. The Taiwanese consumer shops for food at least twice a week, and sometimes, daily. However, those who favor shopping at supermarkets and hypermarkets tend to do one big grocery shopping per week. Top-up food shopping occurs on a daily basis in Taiwan, and is carried out mostly in convenience stores.

Scope of the Report

A complete background analysis of the Taiwanese retail industry, which includes an assessment of the parental market, emerging trends by segments and regional markets, significant changes in market dynamics, and market overview, is covered in the report.

Key Market Trends

Consumer Confidence to Strengthen on Minimum Wage Hike

Consumer confidence in Taiwan is expected to strengthen on recent pay increase. Taiwanese consumers are likely to increase their consumption after the monthly minimum wage in the territory was raised by 4.7% to NTD 22,000 from the previous NTD 21,009, and public sector employees were awarded a 3% pay rise, both effective from 1 January 2018.

Improved consumer confidence and higher income levels are expected to have a positive impact on the retail market, especially the F&B sector.

With changing lifestyle and family structure resulting in the growing prevalence of one-person household, more Taiwanese, especially young adults living in urban cities like Taipei, prefer eating out for convenience and for the variety of cuisine on offer.

Currently, the number of eateries on the island is growing at an average of 3% to 6% each year to over 120,000, according to Channel News Asia. In 2017, total revenue of the catering sector in Taiwan topped NTD 452.3 billion, smashing the record high of NTD 439.4 billion in 2016.

The average Taiwanese consumer prefers to dine out, while dining-in is most commonly carried out by older people or young families co-habiting with their parents. There is a tide of fashionable, urban, singles, couples, and young families turning that notion around, viewing cooking as a recreational activity.

High Growth of Apparel and Footwear Industry

The apparel market is expected to grow annually by 3.5% by 2024. The apparel retail market includes baby clothing, formalwear, formalwear-occasion, toddler clothing, casual wear, essentials, and outerwear for men, women, boys and girls; the market excludes sports-specific clothing. The children’s wear segment was the industry’s most lucrative segment in 2018, holding 45.1% share of the apparel market.

Fast fashion has also proven to be a lucrative sector in the industry, particularly for millennial customers.

Fast fashion brand H&M opened its first store in 2015, and now has a total of 12 outlets across the country. The industry is now highly aware of the power of combining design with aesthetic and cultural creativity. Encouraged and supported by government policy, the industry is actively integrating creativity, innovation, and cultural heritage into design to create unique and refined products. Crossover collaboration is also a new direction to augment market coverage.

Competitive Landscape

The report covers major international players operating in the Taiwanese retail sector. In terms of market share, few of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

Reasons to Purchase this report:

– The market estimate (ME) sheet in Excel format

– Report customization as per the client’s requirements

– 3 months of analyst support

Table of Contents

1. Introduction

1.1 Key Deliverables of the Study

1.2 Study Assumptions

1.3 Research Methodology

2. Scope of Study

3. Market Insights

3.1 Market Overview

3.2 Customer Behavior Analysis

3.3 Industry Attractiveness – Porter’s Five Forces Analysis

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Industry Value Chain Analysis

5. TECHNOLOGY SNAPSHOT

6. MARKET SEGMENTATION

6.1 Food, Beverage, and Tobacco Products

6.2 Personal Care and Household

6.3 Apparel, Footwear, and Accessories

6.4 Furniture, Toys, and Hobby

6.5 Industrial and Automotive

6.6 Electronic and Household Appliances

6.7 Pharmaceuticals, Luxury Goods, and Other Products

7. Insights on Distribution Channels in Retail Trade

7.1 Hypermarkets, Supermarkets, and Convenience Stores

7.2 Specialty Stores

7.3 Department Stores

7.4 E- commerce

7.5 Other Distribution Channels

8. Company Profiles

8.1 President Chain Store Corp.

8.2 Taiwan FamilyMart Co., Ltd.

8.3 Mercuries & Associates Holding Ltd.

8.4 Far Eastern Group

8.5 POYA International Co., Ltd.

8.6 The Eslite Corporation

8.7 Sogo Department Stores Co. Ltd.

8.8 Kayee International Group Co., Ltd

8.9 Carrefour

8.10 RT – Mart

9. Investment Analysis on the Taiwan Retail Sector

10. Future of the Taiwan Retail Sector

Market Segmentation

- Food, Beverage, and Tobacco Products

Personal Care and Household

Apparel, Footwear, and Accessories

Furniture, Toys, and Hobby

Industrial and Automotive

Electronic and Household Appliances

Pharmaceuticals, Luxury Goods, and Other Products

MALAYSIA RETAIL SECTOR – GROWTH, TRENDS, AND FORECAST (2019 – 2024)

| NEO | Published by: Mordor Intelligence | Market: |

| 151 pages | Published: 07-06-2019 |

- NEO

- Mordor Intelligence

- 151 pages

- Published: 07-06-2019

Market Overview

For the third quarter of 2018, the Malaysian retail industry achieved an encouraging growth rate of 6.7%, as compared to the same period in 2017. This latest quarterly result was above market expectation. The Malaysian retail sector market is projected to witness a CAGR of 3.4% during the forecast period. The market is segmented by product category, distribution channel, and market dynamics.

Malaysia has a large and growing food retail market, supplied by local and imported products. In 2018, consumer’s preference started shifting toward stores that offer more convenient, easier way of shopping for groceries. These stores allow consumers to spend less time browsing for goods, and, therefore, enable them to reduce time spent on grocery shopping

The Malaysian national economy recorded a sustainable growth rate of 5.6% for the first quarter of 2018, as compared to -1.2% for retail sales (at current prices). Private investment, export, and public sector consumption were the main drivers of growth during this period.

Scope of the Report

A complete background analysis of the Malaysian retail Industry, which includes an assessment of the parental market, emerging trends by segments, and regional markets. Significant changes in market dynamics and market overview are covered in the report

Key Market Trends

Retail Sector Leading Malaysian Commercial Real Estate Investment

Malaysia’s retail sector ranked top amongst the key players in the commercial real estate investment sentiment survey. All players, namely, developers, fund / REIT managers, and lenders indicate that they will continue to invest/fund the property sub-sector despite the oversupplied market.

Whilst the retail, office and hotel / leisure sub-sectors will continue to see investments from developers; on the other hand, fund / REIT managers are looking to invest in the retail, logistics / industrial, and healthcare / institutional sub-sectors.

Malaysia’s retail industry will continue to play a formidable role in Malaysia’s nation’s commercial property market. The outlook for the retail market, however, did not look rosy in 2018 as an immediate rebound in consumer spending was highly unlikely.

This phenomenon may be alleviated if proper measures are enacted to prevent new retail developments from flooding the market. Besides that, existing retail properties should retool themselves, in order to maintain their relevance in the eyes of patrons.

Despite the unfavorable sentiment surrounding the retail market, the sector will continue to attract investments as developers are expected to collaborate with experienced mall managers to enhance the attractiveness of their assets and remain competitive in the challenging operating environment.

In the current retail landscape, mall operators need to focus beyond the occupancy rate of malls as high occupancy rates no longer equate to high profitability.

Malaysia’s Food and Beverage Industry On Growth

Malaysia’s most significant F&B exports are in the oils and fats category, particularly palm oil-based products, for which the country is one of the two largest exporters in the world.

The F&B industry accounted for approximately 10% of Malaysia’s exports in 2018. The country is also heavily dependent on imports of many staples, including rice, most meat, and seafood, for domestic consumption. Food imports accounted for nearly 8% of total imports in 2018.

The Malaysian food industry is as diverse as the cultures in Malaysia with a wide range of processed food as per the Asian taste. This industry is predominantly Malaysian-owned, dominated by small and medium scale companies (SMEs). Besides the SMEs, there are notable foreign companies and MNCs producing processed food products in Malaysia.

It encompasses sectors, such as cocoa and chocolate products, fishery products, cereals and cereal products, processed fruits and vegetables, confectionery, food ingredients, herbs and spices, beverages, animal feed, and others. Malaysia is currently the largest cocoa processor in Asia. Although Malaysia is the world’s fifth largest cocoa processor, local cocoa bean production could not support the huge demand from the local grinding and processing industry. Most of the cocoa beans are imported.

Competitive Landscape

The report covers major international players operating in the Malaysian retail sector. In terms of market share, few of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets

Reasons to Purchase this report:

– The market estimate (ME) sheet in Excel format

– Report customization as per the client’s requirements

– 3 months of analyst support

Table of Contents

1. Introduction

1.1 Key Deliverables of the Study

1.2 Study Assumptions

1.3 Scope of the Study

2. Research Methodology

3. Executive Summary

4. Market Insights and Dynamics

4.1 Market Overview

4.2 Customer Behavior Analysis

4.3 Industry Attractiveness – Porter’s Five Forces Analysis

4.4 Drivers

4.5 Restraints

4.6 Opportunities

4.7 Industry Value Chain Analysis

4.8 Technology Snapshot

4.9 Insights on Distribution Channels in Retail Trade

4.9.1 Hypermarkets and Supermarkets and Convenience Stores

4.9.2 Specialty Stores

4.9.3 Department Stores

4.9.4 Other Distribution Channels

4.10 E- commerce Trend in Retail Sector

5. Market Segmentation

5.1 BY PRODUCT CATEGORY

5.1.1 Food and Beverage and Tobacco Products

5.1.2 Personal and Household Care

5.1.3 Apparel, Footwear and Accessories

5.1.4 Furniture, Toys, and Hobby

5.1.5 Industrial and Automotive

5.1.6 Electronic and Household Appliances

5.1.7 Pharmaceuticals, Luxury goods, and Other Products

6. Competitive Landscape

6.1 Vendor Market Share

6.2 Mergers & Acquisitions

6.3 Company Profiles

6.3.1 Parkson Holdings Bhd.

6.3.2 Suiwah Corp. Bhd

6.3.3 B.I.G. Store Sdn Bhd

6.3.4 AEON Group

6.3.5 7-Eleven

6.3.6 The Store Corp. Bhd

6.3.7 Robinson & Co

6.3.8 Isetan

6.3.9 MJ Department Stores Sdn Bhd

6.3.10 Tesco

*List not exhaustive

7. Investment Analysis on Malaysia Retail Sector

8. Future of Malaysia Retail Sector

Market Segmentation

- By Product Category

Food and Beverage and Tobacco Products

Personal and Household Care

Apparel, Footwear and Accessories

Furniture, Toys, and Hobby

Industrial and Automotive

Electronic and Household Appliances

Pharmaceuticals, Luxury goods, and Other Products

CHINA RETAIL SECTOR – GROWTH, TRENDS, AND FORECAST (2019 – 2024)

| NEO | Published by: Mordor Intelligence | Market: |

| 175 pages | Published: 07-06-2019 |

- NEO

- Mordor Intelligence

- 175 pages

- Published: 07-06-2019

Market Overview

The Chinese retail sector is projected to witness a CAGR of 10.6% by 2024. The market is segmented by product category, distribution channel, and market dynamics.

China’s economy appears to be stabilizing gradually, boosted by rising industrial production and higher foreign currency reserves. However, questions loom large over its market status and sovereign risk rating. Chinese retail sales were up by 9% in 2018 versus a year earlier, roughly in line with that reported in the past year.

The value of outstanding loans in China increased by 12.9%. This was actually a relatively slow rate of growth, when compared to that of the past several years. From January to September 2018, the retail sales of consumer goods in urban areas was up by 9.1% year-on-year, while that in rural areas was up by 10.4%. China Internet Giants were at the heart of digital retail and they also have been the ones to usher in the new retail era.

Scope of the Report

A complete background analysis of the Chinese retail sector, which includes an assessment of the parental market, emerging trends by segments and regional markets, and significant changes in market dynamics and market overview.

Key Market Trends

Chinese Consumers are Willing to pay for Higher Quality and Unique Experience Products

Retail sales in rural areas grew by 9% this year, about 1-2 percentage points faster than that in urban areas.

Chinese shoppers continue to flock to Western brands, but they are not just seeking out aspirational names in fashion and technology.

Millions of China’s shoppers are also looking to buy everyday items, such as food and personal care products, from international brands, and they are turning to online marketplaces to buy these products directly from overseas brands and retailers.

Chinese demand for imported international brands has created a huge, high-growth market for cross-border e-commerce.

Approximately 24% of China’s digital shoppers had made a cross-border purchase this year, lifting the market’s value by 15% year over year, to USD 115.5 billion. However, that means three-quarter of the country’s online consumers will not be shopping across borders this year, suggesting that there is still plenty of opportunities for Western names to generate demand and capture share in China.

There are three primary supports of the growing Chinese demand for imported goods. It is often cheaper for Chinese shoppers to buy Western brands from cross-border platforms than to buy them from Chinese shops.

Most of China’s Automobile Production are Passenger Cars

Commercial vehicles make up less than 20% of the auto production market. As passenger cars constitute the bulk of automobile production in China, production, sales, and tariffs changes in foreign ownership may affect this market.

The Chinese automobile market is mainly a joint venture market with both domestic and foreign auto producers producing joint venture brands.

This is a legacy of the first auto manufacturing in China, which started with joint ventures. Local brands did not have a chance to develop. There might also be a consumption bias on JV brands, since early on, there may have been little trust in local brands, even if the foreign joint venture brands were manufactured in China.

Most automobile companies in China have joint ventures with European and Japanese manufacturers. There are only a few Korean and American joint ventures. Foreign players have around 60% of sales in the Chinese automobile market, which includes joint ventures. However, one requirement to this are the new energy cars that are being built from scratch recently.

Competitive Landscape

The report covers major international players operating in the Chinese retail sector. In terms of market share, few of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets.

Reasons to Purchase this report:

– The market estimate (ME) sheet in Excel format

– Report customization as per the client’s requirements

– 3 months of analyst support

1. Introduction

1.1 Study Deliverables

1.2 Study Assumptions

1.3 Research Methodology

2. Scope of Study

3. Market Insights

3.1 Market Overview

3.2 Customer Behavior Analysis

3.3 Industry Attractiveness – Porter’s Five Forces Analysis

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Industry Value Chain Analysis

5. Technology Snapshot

6. Market Segmentation

6.1 By Product Category

6.1.1 Food and Beverage and Tobacco Products

6.1.2 Personal and Household Care

6.1.3 Apparel ,Footwear and Accessories

6.1.4 Furniture, Toys & Hobby

6.1.5 Industrial and Automotive

6.1.6 Electronic and Household Appliances

6.1.7 Pharmaceuticals, Luxury goods and Others

6.2 By Distribution Channel

6.2.1 Hypermarkets & Supermarkets and Convenience Stores

6.2.2 Specialty Stores

6.2.3 Department Stores

6.2.4 E-commerce

6.2.5 Other Distribution Channels

7. Company Profiles

7.1 RT Mart

7.2 Costco

7.3 E – Mart

7.4 Hi – Living

7.5 Gmarket

7.6 Home Forever

7.7 Lotte Mart

7.8 Kim’s club

7.9 Newcore Outlet

7.10 Walmart

8. Investment Analysis on China Retail Sector

9. Future of China Retail Sector

By Product Category

- Food and Beverage and Tobacco Products

Personal and Household Care

Apparel ,Footwear and Accessories

Furniture, Toys & Hobby

Industrial and Automotive

Electronic and Household Appliances

Pharmaceuticals, Luxury goods and Others

By Distribution Channel

Hypermarkets & Supermarkets and Convenience Stores

Specialty Stores

Department Stores

E-commerce

Other Distribution Channels